Why Traditional Assets Won’t Cut It Alone This Year

2026 isn’t playing by the old rules. Bond yields are tight, global growth is uneven, and inflation isn’t as dead as the headlines suggest. That’s grinding down returns for investors used to coasting on a 60/40 portfolio. The ultra wealthy see the writing on the wall: it’s not enough to hold and hope. It’s time to rethink what preservation looks like.

High net worth individuals are shifting away from passivity. They’re looking for assets with defenses things that zig when markets zag. Think uncorrelated, tangible, cash generating. Not just storing value, but actively shielding it. This isn’t about chasing hype it’s about staying insulated from volatility while keeping portfolios dynamic.

The move now is toward a more agile and intentional strategy. Passive holding is giving way to curated exposure assets that resist correlation and offer a longer arc of security. For those wanting a deeper breakdown on this shift, check out our guide on diversifying portfolios.

Real Assets Reclaim the Spotlight

When markets turn choppy and inflation refuses to sit still, the ultra wealthy double down on what they can touch. Tangible assets real stuff with intrinsic value are back in vogue for a reason.

First up: farmland. It’s low drama, mostly non correlated, and backed by a pretty simple truth people need to eat. Farmland returns haven’t soared overnight, but that’s kind of the point. It offers sharp defense in portfolios, especially with global demand for food and arable land heading in opposite directions.

Next: infrastructure. Toll roads, ports, data centers. Sexy? No. Reliable? Absolutely. These assets pay out in both bull and bear markets, offering cash flow you can forecast and models that scale with population growth and digital sprawl. Institutions have gobbled this up for years, but now individual ultra high net worth investors are pressing in through funds and co investments.

And then comes the clean wave energy transition assets. Think wind farms, carbon credit portfolios, utility scale battery storage. They’re complex to structure, yes. But they’re also aligned with massive global policy shifts and capital flows. Long game plays. Especially appealing to next gen wealth that wants returns with purpose.

This drive toward real assets is pragmatic. Fancy tech bets are fine, but when you’re safeguarding generational wealth, you’re not betting you’re anchoring. In 2026, tangibles aren’t just a hedge. They’re a statement.

Private Credit and Lending Channels

Direct lending has stepped firmly into the spotlight as institutional and ultra high net worth investors look for alternatives to the seesaw of public credit markets. Instead of buying bonds on the open market, they’re lending directly to businesses earning steady interest while sidestepping some of the volatility that comes with publicly traded debt.

The appeal? Higher yields. Direct lending often comes with stronger returns, especially when borrowers are vetted rigorously. Underwriting has tightened post 2020: borrowers now face closer scrutiny, and lenders are more selective preferring companies with stable cash flows, defensible market positions, and realistic growth plans.

But this isn’t a risk free zone. Direct lending locks up capital often for years with limited options to exit. Regulatory oversight continues to evolve, meaning what’s legally solid today may look different tomorrow. And lender borrower relationships require active maintenance. Missed metrics or weak performance can eat into returns fast.

Still, for those ready to play the long game and willing to get their hands a little dirty, direct lending offers a sturdy hedge, a solid yield, and a front row seat at the table of private capital.

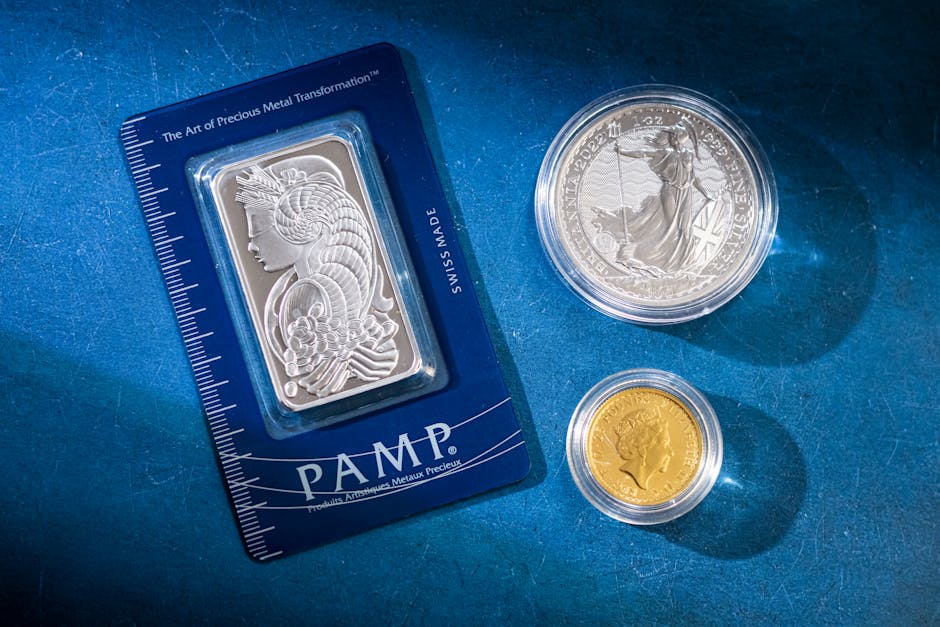

Fine Art, Rare Collectibles, and Tangibles

Paintings, classic cars, and rare watches have always had a certain appeal but now they’re becoming serious contenders in wealth preservation strategies. These aren’t just passion purchases anymore. When chosen carefully, they hold value over time, sometimes beating inflation and even equities during downturns. The kicker? They’re less correlated to traditional markets, which adds stability when stocks get shaky.

Thanks to new platforms, fractional ownership is lowering the barrier to entry. You don’t need to shell out seven figures for a Warhol or a 1960s Ferrari. Investors can now buy in for a slice, just like stocks only with a Maserati behind it. This model has opened the collectible scene to a wider range of high net worth individuals who want exposure without going all in.

But this isn’t a free for all. Research is vital. Provenance, condition, and market demand can make or break your return. Authentication should never be assumed it has to be verified through credible experts or institutions. Tangibles have upside, but only if you treat them like the serious investments they are.

Venture Capital and Growth Equity

Aggressive capital is flowing into venture. The sectors getting the bulk of that attention: AI, biotech, and cleantech. Why? Market defining tech is still being built. AI is reshaping everything from logistics to finance. Biotech is benefitting from breakthroughs post pandemic. And cleantech has political tailwinds and global urgency backing it. For investors chasing the next 10x, this is the hunting ground.

Yes, the risk is real. Startups fail. Timelines stretch. Valuations swing. But for those with the tolerance and the insight it’s a rare window to enter early. Smart money isn’t going in blind. Diligence is sharper now: real traction, experienced founders, and clear regulatory paths are getting priority.

One eye catching shift: multi family offices are cutting out the middle layers. Rather than placing bets through traditional VC firms, they’re building in house VC arms. It gives them tighter control and better alignment with their long term wealth strategies. The bottom line? Venture isn’t fringe anymore it’s core allocation for those playing big and long.

Digital Assets With a Cautious Lens

Crypto isn’t dead it’s just grown up. In 2026, investors are moving beyond the hype cycles of Bitcoin and Ethereum to chase functional digital assets with real world use cases. Tokenized real estate is drawing attention for its potential to unlock liquidity and lower entry barriers. NFTs are no longer just digital art flexes they’re being tied to intellectual property, event access, legal documents, and even identity verification. Add to that the rise of blockchain infrastructure plays think decentralized storage, smart contract platforms, and tokenized logistics and you’ve got a new asset class taking shape.

But it’s not all blue sky. Regulation is a looming presence, and it’s reshaping how the wealthy approach these assets. Jurisdictional clarity, tax reporting standards, and risk classification all matter now and they’re slowing down casual adoption. Institutions aren’t playing fast and loose anymore, and neither should HNWIs.

That’s where custody and compliance come in. The name of the game in 2026 is institutional grade everything. Cold storage, multi sig wallets, third party audits, KYC/AML protocols these aren’t optional. For family offices and private investors, the digital play is less about riding the next wave and more about building quiet positions in infrastructure they understand, control, and can explain to regulators if needed.

Bottom Line: Don’t Just Defend Innovate

Preserving wealth in 2026 means being smarter than the market, not hiding from it. That starts by avoiding overexposure to any single asset class. Smart investors are layering their portfolios with a mix of real assets, private market plays, and digital innovations not just doubling down on equities or cash.

The key is balance. Think of your portfolio like a team: you need defenders (passive assets like core real estate or bonds) and aggressive players (growth equity, venture capital, private credit). The ultra wealthy aren’t just protecting they’re pursuing upside in off market niches while keeping protection in place if the macro climate gets rough.

It’s not about gambling. It’s about building something that can handle both tailwinds and turbulence. For a deeper look into how top investors are pulling this off, read our deep dive on diversifying portfolios.